zerodha demat account review quora

[Updated on – 13 Jan 2021]

Zerodha Review: founded in 2010, Zerodha was the first broking firm that introduced the flat brokerage fee per order in India, which can help you save up to 90% on your brokerage charges.

If you are a day trader you have to pay a minimum of Rs. 20 per order, which is very low compared to the traditional brokers.

You can save a good amount on brokerage with a flat fee per order. Let me show you the comparison of both scenarios; Flat Fee vs. Percentage Brokerage.

If you do 10 trades (20 trades including buying & selling) of Rs. 10,00,000 every month, you will have to pay charges as below:

ICICI Securities

Brokerage charges: 0.55% (Includes both buying & selling)

Rs.10,00,000 * 0.55% = Rs. 5,500

One year cost will be Rs. 5,500*12 = Rs. 66,000

Annual brokerage cost of Rs. 66,000 is huge.

Zerodha

Brokerage charges:- Rs. 20/order or (0.03% whichever is lower)

20 trades * Rs. 20 = Rs. 400

One year's cost will be Rs. 400 * 12 = Rs. 4,800.

If you trade for Rs. 10,00,000 in 20 trades, you will have to pay Rs. 4,800 only.

Now you have seen the difference.

Zerodha Brokerage Charges

Zerodha charges ZERO fee on the stock delivery. That means, if you are investing in stocks for long-term, you won't have to pay any brokerage.

For intraday, trading charges are Flat Rs. 20 or 0.01%, whichever is lower.

Intraday trading includes equity, currency, and commodity trading.

| Category | Charges |

| Equity Delivery | Zero |

| Equity Intraday Trading | Rs. 20 or 0.03% (whichever is lower) |

| Equity Options | Flat Rs. 20 per executed order |

| Equity Futures | Rs. 20 or 0.03% (whichever is lower) |

| Currency Options | Rs. 20 or 0.03% (whichever is lower) |

| Commodity F&O | Rs. 20 or 0.03% (whichever is lower) |

Zerodha Annual Charges

Zerodha's Annual Maintenance Charge is Rs. 300.

Zerodha charges quarterly. So you have to pay Rs. 75 every three months from the date of account opening.

Other Charges

Account opening charges for Trading & Demat account is Rs. 200 and for commodity account is Rs. 100.

Depository Participant (DP) charges on equity stock are Rs. 13.5 per scrip. You have to pay DP charges when you sell the shares from your demat account.

Earlier, there were charges on the redemption of mutual funds also, which are no longer charged since May 3, 2019.

Zerodha Demat & Trading Account Additional Features

#1. 3-in-1 Account with IDFC FIRST Bank

You need an IDFC First bank account to open a 3-in-1 Zerodha account that includes bank account, Demat & trading account. Once you have an IDFC First bank account you can call 080 4913 2020, the team will help you open a 3-in-1 account.

The 3-in-1 account allows you hassle-free fund transfer from the bank account to the trading account. Fund transfer is free of cost. There's no upper limit on fund transfer.

#2. IPO Purchase Facility

You can buy IPOs using Zerodha's Console.

You will get the IPO option in the 'Portfolio Menu'. Click on IPO & select the desired IPO from the list. Then you have to enter UPI ID to complete the payment.

Make sure that your details are matched with bank details which means only Zerodha's logged-in user can apply for IPO from the console. You can't use your ID to apply on any other person's behalf.

#3. NRI Account facility

It is an offline process. Zerodha supports two banks HDFC & Axis.

If you have a PIS (Portfolio Investment Scheme) account in these banks, you can get an NRI trading account at Zerodha.

Account opening charges are Rs. 500.

Brokerage charges are;

- Rs. 100/order for F&O

- Rs. 200/order or 0.1% (whichever is low) for Equity

#4. Margin Facility

Zerodha offers margin on 3 different products; MIS, Bracket, and Cover Orders.

The margin provided on all products is 3-12.5% that is 8x depending on the scrip.

As per SEBI's new guidelines, no broker can give a high amount of leverage to their customers.

Benefits of Zerodha Demat and Trading Account

- Free equity delivery

- Flat brokerage is cost-effective for a regular trader

- Hassle-free investments in IPO using UPI payments

- In-depth reports and vast historical data for better analysis

- Enable user to invest directly in mutual funds

- Ease of creating multiple trading strategies & alerts

- Better customer support, they even quickly respond to Google play reviews.

Cons of Zerodha Demat & Trading Account

- Server slows down during peak hours

- NRI account available with HDFC, Axis and Yes bank only.

Also read – 5paisa Demat/Trading Account review .

Zerodha Additional Products

#1. Console

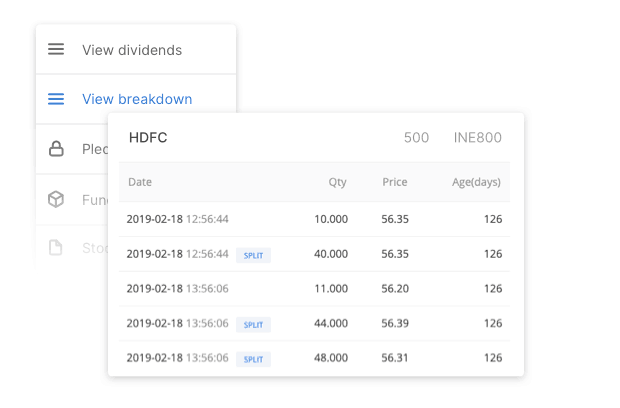

Console is a central dashboard for your Zerodha account holders. You get insights about your trades and investments with in-depth reports and visualizations.

You get a complete history of your stocks trade from the day of acquisition. You can understand your trades in a better way with a per-trade charge breakdown.

Console keeps track of corporate actions, splits, and transfers to produce the most accurate profit and loss statements (P&L) for your portfolio.

You get tax-ready reports covering your capital gains/losses that you can submit directly to your Chartered Accountant.

You can also apply for IPOs using UPI (BHIM).

#2. Coin

Zerodha Coin is India's largest direct investment mutual fund platform. Coin enables you to buy mutual funds directly free of cost. You don't have to pay a commission because you buy directly from asset management companies.

Initially, Zerodha was charging Rs. 50/month for investments above Rs. 25,000 using Coin but in August 2018 they made it free to encourage direct mutual funds investments.

You can use the "Coin" app on your iPhone or any Android phone to invest in mutual funds on the go.

Other benefits:

- You can create, pause or modify SIPs anytime using Coin

- You can search for funds under themes, categories, and scheme details

- Get detailed information on underlying securities & sector-wise data

- Purchases funds instantly using UPI payments like BHIM

- You can automate fund transfers through eMandates to fund your SIPs

- Fund house managers views in the form of short videos

#3. Varsity Mobile

Varsity is a free learning app available for smartphone users.

You can learn about the stock market on your phone in small size cards. Beautiful illustrations help you understand complex concepts in an easy way.

You will find each topic to be broken down into 3 difficulty levels and a quiz at the end of each level. You can also take up a certification exam to challenge yourself.

It is available both on Appstore and Google Play.

#4. Sentinel

Sentinel is a cloud-based tool that gives real-time market alerts for stocks, bonds, commodities, bids, offers, and more.

You can create 3 types of alerts:

- Basic Triggers: It helps you set alerts based on price, trade quantity, and volume.

- Advanced Triggers: It allows you to create advanced alerts combining multiple conditions.

- Baskets: It alerts you to take one-click action on pre-set orders for a group of scrips.

For example, if you are looking for investment opportunities in the banking sector, you can create a basket with BUY orders at specific prices for different bank stocks like HDFC Bank, ICICI Bank, and SBI.

Now you set an alert trigger like this; if the last traded price of (LTP) of Bank Nifty is greater than or equal to 30,000, give an alert with the option to place all the pre-set orders in the banking stocks in your basket.

You have to signup to use Sentinel where you can set up the alerts as per your requirement.

Zerodha Trading Platforms

#1. Kite

Kite is a fast & intuitively designed trading platform that allows you to trade equities, F&O, commodities, and currency. You receive updated information with live streaming of the latest market trends without any lag.

You can search across 90,000+ stocks across multiple exchanges instantly. You get multiple MarketWatch and live market depths up to level-3.

Kite's level-3 data gives you deeper insights into market liquidity and allows you to set trading strategies accordingly.

You get 100+ indicators with an advanced charting interface.

Good Till Trigger

Good Till Trigger (GTT) allows you to set a trigger price. When your trigger price hits in a future date, a limit order will be placed on exchange as per the conditions set by you.

The trigger set on GTT is valid one time only. If the order is placed but it doesn't get executed for any reason, you have to create a new trigger.

You can use GTT only for CNC Type orders.

#2. Kite Connect

Kite Connect is a tool to create powerful trading platforms using simple HTTP/JSON APIs.

You can build your own investment app using these APIs and showcase that to Zerodha's client base. Coin, SmallCase, and Streak are examples of investment/trading apps built over Kite Connect.

#3. SmallCase

SmallCase allows you to build a diversified, low-cost portfolio for long-term investment purposes. A small case diversifies your portfolio with multiple stocks and protects you against market volatility of the market.

You have to pay fees only when you transact for mutual funds without paying any maintenance fee. You can invest in stocks and hold it in your account.

You can also invest in SIPs for regular & less risky investments if you are a newbie.

#4. Streak

Streak is the world's first platform for traders to create, backtest, and deploy trading strategies without any coding skills.

You can track real-time market trends, get alerts, and manage positions.

Streak work in 3 steps:

1. Create

You can create trading strategies by typing technical indicators, selecting stocks you want to trade, and targeting profit percentage.

Streak provides you 70+ technical indicators to create more than 1 million unique strategies using different combinations.

2. Backtest

Backtesting allows a trader to simulate a strategy using previous years' data to analyze risk and profitability before putting actual money at risk.

You can analyze maximum gains/loss, average gain/loss per trade, and much more.

These metrics help you decide the accuracy of your strategy.

3. Deploy

Once you have backtested the strategy successfully, you can deploy that without any need to track the stock manually.

Streak tracks the stock movements & send actionable single-click alerts when all the strategy conditions are met.

You can use up to 20 scrips at a time in a single strategy.

Streak is available on Google Play & Appstore as well so that you can track everything on the go.

#5. Sensibull

Zerodha has collaborated with Sensibull to provide customers with the 'Options Trading' platform. You can trade Nifty Options, Bank Nifty Options, Stock Options, and many more.

You get expert advice in real-time on Whatsapp.

You can also learn trading with video lessons and practice virtually without investing real money.

Sensibull has three plans; Free, Lite, and Pro.

#6. GoldenPi

Golden Pi is India's first online platform to invest in bonds and debentures.

If you want to get better returns than Fixed Deposits but don't want to take the risk, then you can invest in bonds & debentures to get fixed returns on your investments.

Start investing in 3 steps:

- Choose bonds that match your goals

- Complete KYC online

- Make the payment online and receive bonds in your Demat account.

Comparison Between Zerodha and Upstox

| Zerodha | Upstox |

| Only one brokerage for all customers – Flat Rs. 20/order or 0.03% (whichever is lower.) | Rs. 20/order or 0.05% brokerage whichever is lower. The premium plan offers Rs. 30/trade or 0.10% whichever is lower but no monthly charges. |

| No streamlined process to get a 3-in-1 account facility. | A simple online process for the 3-in-1 account in partnership with IndusInd bank |

| Facility to invest in IPO with UPI | No facility to invest in IPO |

| Zerodha offers direct mutual funds investment. | Upstox offers regular mutual funds for investment. |

Conclusion

Zerodha is a good platform for high volume traders as you need to pay a flat fee per trade irrespective of your trade volume.

Professional traders can get detailed analysis with tools to create trading strategies. The additional feature is you can also apply for IPOs using UPI (BHIM).

zerodha demat account review quora

Source: https://simpleinterest.in/reviews/zerodha-review/

Post a Comment